Several retailers, such as Patagonia, are now stopping their internet retailers to support the employees in their supply chain. Aside from how our personal lives have changed, companies are grappling with furloughs, supply chain problems, closing down retail shops, and learning how to manage the retail world in a moment of social distancing. As we continue to run our supply chain and support our stores throughout COVID-19, we will bring lessons learned and resources out of it into the hurricane season. “H-E-B soon realised that their consumers relied on them, almost 100%, for their food and beverage needs.

Disruptions in the supply chain that occurred in China in the early days of the coronavirus epidemic disrupted the availability of supplies and shipping times. Debrief Me is now planning to extend its mask range to 10 separate items, with plans to market the masks in large retail stores, but Silver has declined to say where. “We’re receiving calls from department outlets and referring to several of the big-box retailers,” Silver says. “We are increasing vigorously across the world.” Expect distribution delays for online orders Though, not all retailers have achieved revenue increases due to the abundance of challenges connected with COVID-19, such as supply chain issues and potentially fewer customers in shops that do not want to risk publicity.

For example, there is a substantial effect on imports at major U.S. retail container ports due to plant shutdowns and travel restrictions in China that influence supply and efficiency, according to the Global Port Tracker study published this week by the National Retail Federation and Hackett Associates. “There are still a number of unknowns to completely assess the effect of coronavirus on the supply chain,” says Jonathan Gold, NRF Vice President, Supply Chain and Customs Management. “As factories in China keep going back online, goods are now streaming again. One extra feature worth calling attention to in this initiative is Google Consumer Reviews, a software that lets you gather and show input from customers who have made transactions from your online shop.

If you’ve allowed Google Consumer feedback, if a customer orders a product from your BigCommerce shop, they’ll be asked if they’d like to rate it on Google (after it’s delivered). I don’t think it’s too premature to conclude that the global pandemic of COVID-19 is likely to be one of the defining events of 2020, and that it will have consequences that last long throughout the decade. And delivery conditions are still a difficult world for COVID-19, so it’s not possible that you’ll be open to the package itself either.

Although survey results suggest that women are more likely to be worried about the consequences of COVID-19, it also indicates that men are more likely to have an affect on their shopping behaviour. For stores around the world, the last six weeks have been inconceivable. Apart from how our personal lives have changed, companies are grappling with furloughs, supply chain problems, the closing of department outlets, and trying to manage the retail landscape in a time of social distancing. Simply put, the propagation of COVID-19 has left both non-and non-essential retail companies in dismay. For others, federal executive orders are making tough decisions for them. Others are doing what they can to keep their local companies going with curbside pickup, take-out services, and relying on online orders.

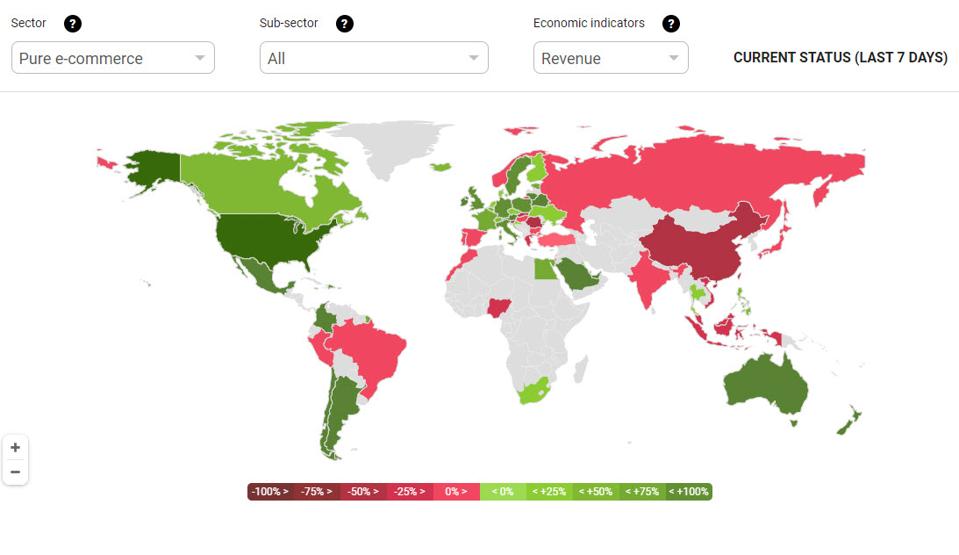

Such an impactful pandemic would be impossible to ignore. Consumers spent the last 6-8 weeks at home in the United States. Any of the nation’s most populous cities , such as New York, now have no foot traffic, and the noise of busy streets has been replaced by cheering from the high-rise balconies of residents cheering those on the front lines. Consumers’ lifestyles have changed almost overnight across the world, and their buying behaviour fits a similar trend. Data from April 2020, aggregated by the Common Thread Group, reveals when and how customers have changed their spending.

When customers are told to stay home across the world and closures are becoming a temporary trend, the retail sector has no alternative but to adapt. This has pushed stores to re-imagine consumer service, such as restaurants selling on-site grocery delivery and alcoholic drinks in states like Texas. In addition, only a few weeks after the lockdown, Walmart announced that they were seeing an increase in the clothes tops, an indication that those operating from home are prioritising their look from the waist up.

As customers are sheltering in their homes, the negative effect of the COVID-19 virus is influencing all brick-and – mortar retailers and e-commerce retailers. In this unusual situation, some e-commerce dealers are noticing that their goods are selling higher than normal and are having trouble keeping up with demand, whereas most stores supplying “non-essential” goods have seen a sharp drop in sales. Working and schooling from home has pushed the market for laptops, mobile, scanners, and other office goods as people transition to this way of life. Other things that sell well are home gym equipment, kitchen utensils, and home renovation accessories. Cab fever, board games , online services, and certain leisure items are sold more than normal. Although retailers selling toilet paper, face masks and bottles of water are seeing substantial benefits from coronavirus, some are nervous that this would have a significant effect on their 2020 sales.

Retailers are increasingly changing their tactics to respond to COVID-19. Learn how retailers are going to look after COVID-19 and what your store is expected to do to be successful. Right now, the key concern is probably: but what if the entire environment is going to break down?

If you think at as far as five years ago, eCommerce wasn’t as common as it is today. Many companies had sunk their toes into eCommerce waters, but had yet to commit to treating it as a key part of their marketing plan. Over the years, an entire sector of companies has arisen to replace the pitiful ‘Big Box Middleman,’ and the idea of direct-to-consumer (DTC) has now become part of the lingua franca economy – with which customers have responded to the simplicity and comfort of shopping not only online, but also social media such as Instagram and Facebook.

We started to see a steady upward trend in the adoption of eCommerce, while at the beginning of 2020 it only accounted for just 16% of overall retail sales Until COVID-19 struck, everything changed and the adoption of eCommerce across industries was endlessly pushed ahead. Once there was a balance between the types of items that consumers buy online and what they buy in physical retail stores, COVID-19 made it the only choice.

After two months of this “fresh standard” online shopping, BigCommerce data has shown that buyers are shopping online at a significantly higher pace than we have seen previously. In reality, we’ve seen a few weeks where online transactions on the BigCommerce Platform boosted revenue during Cyber Week 2019. In our most recent numbers, looking at Week 20 (May 10-16), overall GMV sales on the BigCommerce platform were 93% higher than the same week in 2019. Some groups, such as furniture, see YoY growth as high as 263 percent!